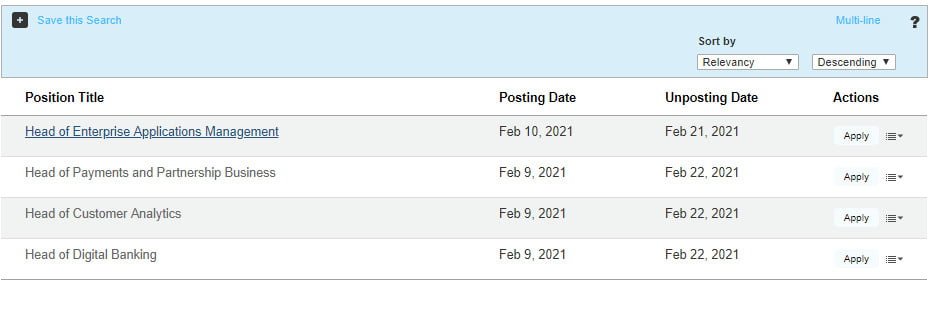

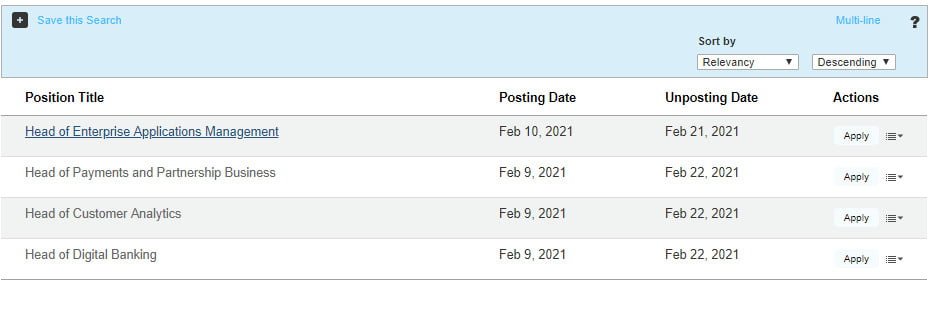

BRAC Bank jobs circular 2021 job circulars of various online websites, news paper , professional and non-professional organizations by public our website jobscirculars.com

Job Title : Head of Enterprise Applications Management

Job Title : Head of Payments and Partnership Business

Job Title : Head of Customer Analytics

Job Title : Head of Digital Banking

Head of Enterprise Applications Management

Description

– Lead, supervise and manage of application management team to ensure that IT applications are designed, build, deployed and performing efficiently in line with the organization’s business and financial need.

– Overall responsible to ensure application management and smooth Operation and support (Service Request, Technical support, incident & problem management), System availability in accordance with agreed SLA & KPIs and management reporting. Manages IT applications including licensing, products, services and regulatory compliance.

– Develops and maintains relevant performance metrics to assess system and data integrity including release planning, execution and quality assurance.

– Develop and maintain strong working relationships with business stakeholders at all levels to understand their business drivers and work to deliver/promote technical solutions as appropriate.

– Develop and drive a high-level Application management strategy that ensures high quality support at a fast pace, as well as take a hands-on approach to implementing that strategy.

– Assist and ensure to provide best in class support services to ensure the prompt resolution of all requests in line with the Service/Operational Level Expectations.

– To ensure change control for applications and ensure thorough System/UAT testing prior to a full and controlled release

– Lead, hire, train, develop, organize and motive the enterprise systems management team.

– Manage supplier and vendor relationship to ensure that existing applications are optimized to meet business needs.

– Ensure compliance with controls, policies and procedures as per auditors and monitor’s recommendations.

– Follow and establish best practices such as ISO, service management and ITIL standards.

Qualifications

- Bachelor of Science (BSc) or Master of Science (MSc) in Computer Science (CS) and Engineering or Equivalent degree from a reputed university. Having MBA will be an added advantage.

- Minimum 10 years solid experience in application management / maintenance / development and team leader in large information technology environment.

- Experience in working in financial or telecom industry is preferable.

- Strong leadership and team management capability

- Solid experience to manage, maintain and develop of applications such as Banking Applications, ERP, Mobile Apps, Document Management Systems, Loan Origination System and Internet Banking Application would be required.

- Should have Hands on experience in ISO , ITIL, Service management, Availability and release management.

- Require to have sound knowledge on application architecture, development life cycle, development languages (i.e. .Net, Java) and databases (i.e. oracle, sql server).

- Able to work under pressure, problem solving & team playing attitude.

- Can Do, Proactive, passionate.

- Good communication and interpersonal skill.

Head of Payments and Partnership Business

- Lead the strategy, idea generation and concept validation of new payment services/platform design, enhancements and implementation of solutions for enabling B2B and B2C interactions leveraging custom payments management platform for all domestic payment requirements.

- Drive the go to market strategy for our Payments offering, positioning BRAC Bank as a key player in the payment space, bridging the business, market and technical environment by managing all external facing activity with clients, banks, FinTechs, PSO, WLAMA, PSP’s etc.

- Evaluate the specific solutions within the payments space. Help build & orchestrate a team responsible/ accountable across a clear set of priorities for designing solutions and identifying which solution to build, partner or buy.

- Provide business direction to the team members for helping arrive at our payments strategy in the market.

- Identify existing products and solutions in the market and identify payment workflows, development and delivery of digital payment services/API’s working with Architecture, Engineering, Testing, Finance, Operation and marketing teams.

- Preparing business case and recommend pricing/cost models.

- Define win themes, solution strategy and assess competitiveness of our solution approach for deal pursuits in partnership with Cash Management, SME & Retail team.

- Develop competitive analytics capability to determine target pricing on deal pursuits using external / internal data

- Collaborating extensively across internal business partners that span our diverse target industries and deliver the payments management platform as a capability to existing and future technology applications that service these industries.

- Masters / Bachelor’s degree in Business or Engineering/ Technology from reputed universities with satisfactory academic track record.

- Minimum 5 years of industry experience in the payments industry, E-Commerce Acquiring Business / any other relevant business, 2+ years of experience in managing the outcome of technology organizations building payments platforms/solution.

- Understands Payments Industry value chain, underlying Payments infrastructure, FinTech players & the emerging Technologies/Standards/ Business models in Payments space.

- Understanding of Payment & Card industry with the basics of Debit, Credit, Prepaid Cards and other upcoming payment mediums.

- Business/Technical Acumen: must be comfortable and move with ease between both business and technology environments and work effectively in each.

- Balanced experience across Retail and Institutional payments; understanding how retail payments play into the bigger institutional money movement.

- Must be able to demonstrate the skill of closing deals and creating leads.

- Experience of managing group of cross-functional people is a must.

- Experience in Banking Industry / Payment processing would be an added advantage.

- Good analytical ability will be appreciated.

- Proactive, passionate and with a can do attitude.

- Good communication and interpersonal skill.

- Proficiency in Microsoft Office package is a must.

- Database knowledge would be an added advantage.

- Attention to detail is a must.

Head of Customer Analytics

- Work on data analysis and development of conclusions and recommendations for stakeholder.

- Design and execute analytics practices to generate data-driven insights and recommendations for marketing leadership.

- Design, build, automate and maintain well-structured data marts. Proactively address any issues with data quality, accuracy and completeness.

- Apply critical thinking to resolve data issues and combine data from multiple systems through tools such as SQL, SAS, Python, R etc.

- Identify opportunities and threats for the Bank through analysis of market conditions and trends, existing KPI reports, executive leadership guidance, and ad hoc data warehouse research.

- Analyze strategy performance by distilling massively complex data into concise and actionable recommendations.

- Present recommendations for strategy improvements and provide strong justifying evidence to defend these recommendations. Gain alignment across work groups and implement these changes.

- Create and maintain strong working relationships with multiple business teams, technology teams and key vendors.

- Produce a range of dashboards, reports and presentations.

- Masters / Bachelor’s degree in Engineering, Technology, Statistics from reputed universities with satisfactory academic track record.

- At least 10 years of work experience in relevant field.

- Good analytical ability is a must.

- Attention to detail is a must.

- Proficiency in Microsoft Office package, MS SQL Server, MS Access is a must.

- Proficiency in SAS, Tableau, Qlik View or any other analytical tool will be an added advantage

- Understanding of Debit, Credit, Prepaid Cards, Loans & Deposit product dynamics under Retail & SME banking will be a plus.

- Proactive, passionate and with a can do attitude.

- Good communication and interpersonal skill.

Head of Digital Banking

- Lead and formulate digitalization strategy to achieve overall digital transformation and meet organizational objectives.

- Maintain strategic relationship with central bank as well as government bodies to ensure and cope up with the digitalization movement from industry perspective.

- Work closely with segment and product managers to prepare business requirements with the best market practice and excellent customer experience.

- Understand the market situation and availability of new digital services, conduct market analysis and propose enhancement recommendations.

- Identify and inventory current existing products and solutions in the market and identify payment workflows, development and delivery of digital payment services/API’s working with Architecture, Engineering, Testing, Finance, Operation and marketing teams.

- Preparing business case and recommend pricing/cost models.

- Define win themes, solution strategy and assess competitiveness of our solution approach for deal pursuits in partnership with Cash Management, SME & Retail team.

- Masters / Bachelor’s degree in Computer Science (CS) / Engineering or Business from reputed universities with satisfactory academic track record. Having MBA will be an added advantage.

- At least 5 years’ industry experience in similar roles, preferably with a significant track record in managing digital services /solutions / products.

- Creative approach, with the ability to anticipate challenges and develop innovative solutions.

- A good team player and self-motivated with strong analytical mindset plus able to manage multiple projects.

- Understanding of Payment & Card industry with the basics of Debit, Credit, Prepaid Cards and other upcoming payment mediums is a plus.

- Business/Technical Acumen: must be comfortable and move with ease between both business and technology environments and work effectively in each.

- Ability to work and make decisions independently as well as collaborate effectively as part of a wider team.

- Strong persuasion and communication skills.

- Excellent stakeholder management skills.

BRAC Bank jobs circular 2021

Saptahik Chakrir Dak 12 February 2021 Download

Chakrir Dak Weekly Newspaper | 23 Octoder 2020 . Bd job news today. weekly chakrir khobor. Chakrir Dak Weekly Jobs Newspaper. Saptahik Chakrir Khobor Newspaper bd, BD govt Job Circular 2020.Company job Circular 2020. Ongoing All Government Job Circular 2020.

If you want to latest Chakrir Dak news in Bangladesh, you can check our website. In this site we are providing recent daily employment news. However, our publishing job circular are, new jobs, dmlc admit card , road and highway job circular, sorok o jonopod circular, rajuk job circular application form, baec teletalk corn bd, dpe notice, dhaka cantonment board job application form, nbr job exam date, bangladesh somorasro karkhana, nbr job result, pani union board result, ministry of defence job circular 2020,new defence job circular, ministry of defence bd exam question, defence auditor job circular, mopa.gov.bd application form pdf, ministry of defence exam result 2020 and many more.

Join Our official Social Media So that You can more information of new job circular, govt job circular, private job Circular.

Facebook : https://www.facebook.com/jobscircularsbd Twitter : https://twitter.com/jobscirculars Pinterest : https://www.pinterest.com/jobscirculars Instagram : https://www.instagram.com/jobscirculars linkedin : https://www.linkedin.com/in/jobscircularsofficial